The flip side of the argument is a promise of rapid economic growth, and the true picture depends on whose predictions you believe.

President Donald Trump is much more optimistic than the Congressional Budget Office.

The CBO is tasked with providing independent, nonpartisan analysis of economic and budgetary issues to support the Congressional budget process.

It produces objective analyses for all Congressional committees, primarily for the different budget committees, but also works with the House and Senate appropriations committees, the House Ways and Means and Senate Finance committees.

The CBO predicts just 0.8% Gross Domestic Product growth from the bill.

The White House, however, contends that CBO projections do not fully account for growth and revenue generated by the bill’s trade policies, including new tariffs.

Sen. Roger Marshall (R-Kansas), in an appearance on Washington Watch Thursday, said GDP growth is ahead of schedule.

“We’re having a GDP growth maybe of 4.6% this quarter. You know, (Joe Biden) sat there and thought it was going to be a half a percent, but it's probably 4.6 percent. There's lots of tariff money coming in right now, way ahead of schedule,” he told show host Tony Perkins.

Trump met with lawmakers to discuss the bill Wednesday.

“He thinks it'll do economically, that it's going to grow the economy three or four percent. The Congressional Budget Office is saying that we'll only have 1.8 percent growth. President Trump thinks we're going to have three or four percent growth,” Marshall said.

The House Ways and Means Committee projects GDP increase of 5.2% over the next four years and 3.5% after that.

Because it makes Trump’s 2017 tax cuts permanent, the bill will “protect the average taxpayer from a 22% tax hike,” which the committee says is equivalent to nine weeks of groceries.

Because it makes Trump’s 2017 tax cuts permanent, the bill will “protect the average taxpayer from a 22% tax hike,” which the committee says is equivalent to nine weeks of groceries.

Avoiding the tax hike also leads to increased wages and take-home pay, the committee says.

Senate Majority Leader John Thune left the meeting with Trump promising that while some in the GOP have been harsh critics of the bill, Senate Republicans and the president are on the same page.

“We had a very positive discussion about the path forward on the Big Beautiful Bill and the reconciliation bill. I think it was a reminder that we are all in this together. This is a team effort, and everybody is going to be rolling in the same direction to get this across the finish line,” Thune said.

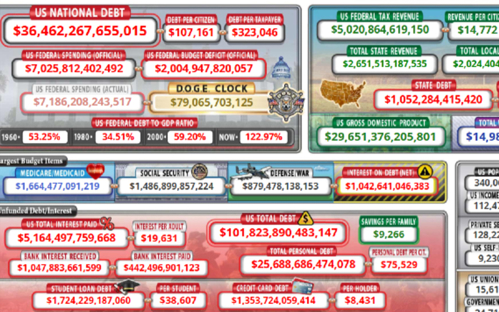

A nation $37 trillion in debt

That finish line will include adding to a U.S. debt that is rapidly approaching $37 trillion.

Left unchecked, the effects could range from negative impacts on investment portfolios to increased borrowing costs, further credit downgrades and general economic instability, economists say.

Left unchecked, the effects could range from negative impacts on investment portfolios to increased borrowing costs, further credit downgrades and general economic instability, economists say.

For now, there’s $15 trillion in pledged foreign investment, much of it from Trump’s recent Middle East tour.

Marshall says too much focus on short-term deficit increase misses the point in the big picture.

“At the end of the day, this bill is going to impact to the good $8 trillion towards our national debt, that this bill is going to lower our national debt some $8 trillion over 10 years,” he said.

The moral part of the bill

There are important non-economic considerations in the bill, says Marshall, an obstetrician-gynecologist for more than 25 years before winning election to the Senate.

“We defund Planned Parenthood, we cut funding for Obamacare insurance policies if they perform abortions, and we stop federal funding for any of the transgender surgeries,” he said.

Planned Parenthood, the nation’s largest provider of abortion services, received almost $800 million from taxpayers in 2024.

Planned Parenthood, the nation’s largest provider of abortion services, received almost $800 million from taxpayers in 2024.

That’s more than three quarters of a billion dollars, an average of almost $2.2 million each day, Jordan Sekulow writes for Townhall.com.

Subtracting abortion money is big, but protections for minors from transgender procedures should not be overlooked, Marshall said.

“I'm especially grateful for this opportunity to stop the funding of mutilation of our children. This is child abuse, and I am just so honored that we can be part of stopping that federal program,” he said.

“There’s a moral part of this bill that’s important,” Marshall continued. “We’ve increased the child tax credit. We’re trying to make this a pro-family, pro-American values bill.”