The boondoggle of a bill, estimated to cost $720 billion, is now headed to the U.S. House after passing the Senate, where Vice President Kamala Harris cast a tie-breaking vote, The Associated Press reported earlier this week.

IRS promises new 'resources' will target only wealthySteve Jordahl, AFN.net The so-called Inflation Reduction Act that is being bashed for failing to do just that is being noticed for another reason, too: Adding a whopping 87,000 IRS agents to the already-feared federal agency. After the bill passed the U.S. Senate this week, where it now heads to the House, CNBC reported the Act allocates $80 billion to the IRS. Of that new funding, $45.6 billion goes for “enforcement,” which means exactly what is sounds like: Newly-hired agents will be poring over personal and business tax returns looking for questionable tax credits and tax deductions. “Americans should be very worried about the growth of government anytime that happens,” Jeff Crank, a Colorado-based radio host, tells AFN, “but particularly when it happens with the Internal Revenue Service.” According to Democrats, citing an August 4 letter from IRS Commissioner Charles Rettig, the new army of agents will audit large corporations and wealthy individuals, not small businesses and middle-class wage earners. The new “enforcement resources” will not audit households making under $400,000 a year, the letter further states, but critics have pointed out 98% of the population earns less than $400,000 annually.

Because the bill's language states the new funding is not intended to audit middle-class Americans, Sen. Mike Crapo (R-Idaho) offered an amendment to the Act to ensure the IRS will not use the new agents to target Americans earning less than $400,000, but Democrats voted down his amendment. Citing audit figures from the IRS, journalism website ProPublica reported in 2019 that the poor state of Mississippi, in particular counties in the Mississippi Delta, experienced the most audits per 1,000 filings than anywhere else in the country. “When you hire 87,000 new workers for the IRS,” Crank summarizes, “they’re going to find something to do.” |

In that same AP story, the wire service summarized the legislation:

It includes the largest-ever federal effort on alleged climate change — close to $400 billion — caps out-of-pocket drug costs for seniors on Medicare to $2,000 a year and extends expiring subsidies that help 13 million people afford health insurance. By raising corporate taxes and reaping savings from the long-sought goal of allowing the government to negotiate drug prices for Medicare, the whole package is paid for, with some $300 billion extra revenue for deficit reduction.

Missing from that summary is the word “inflation” but the AP notes, farther down in its story, that “nonpartisan analysts” have said the Inflation Reduction Act will have a “minor effect on surging consumer prices.”

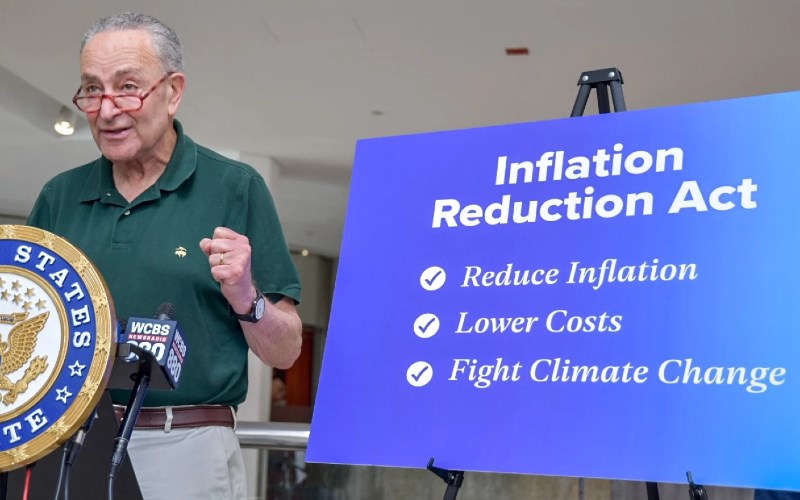

Those “surging consumer prices” that are hitting records not seen in 40 years include milk (16%), eggs (33%), and chicken (18%) you put in your grocery cart, and the summer electric bill in the Northeast (16%), and nearly everything sold on a store shelf or at a gas pump, but Senate Majority Leader Chuck Schumer said the bill will “endure as one of the defining legislative feats of the 21st Century.”

Those “surging consumer prices” that are hitting records not seen in 40 years include milk (16%), eggs (33%), and chicken (18%) you put in your grocery cart, and the summer electric bill in the Northeast (16%), and nearly everything sold on a store shelf or at a gas pump, but Senate Majority Leader Chuck Schumer said the bill will “endure as one of the defining legislative feats of the 21st Century.”

Dan Kish of the Institute for Energy Research says the bill reads like a newer version of the Green New Deal than addressing inflation reduction for energy.

“This bill raises taxes on coal and oil and gas fees – you name it,” he tells AFN, because the climate change activists are pushing the public to drive electric vehicles and to depend on wind and solar.

“That is precisely what the bill does, and it takes a huge amount of money to do so,” he complains. "And as they roll out the provisions, it is going to be very harmful."

When it comes to electric vehicles, The Associated Press admitted that most already-expensive electric vehicles don’t even qualify for a $7,500 federal tax credit included in the Inflation Reduction Act. That is because the bill stipulates the automobile must use a battery that was manufactured in North America, when 50 of 72 models sold in the U.S. don’t meet that standard.

When it comes to electric vehicles, The Associated Press admitted that most already-expensive electric vehicles don’t even qualify for a $7,500 federal tax credit included in the Inflation Reduction Act. That is because the bill stipulates the automobile must use a battery that was manufactured in North America, when 50 of 72 models sold in the U.S. don’t meet that standard.

"This bill has just turned into a monstrosity of government spending," says Carson Steelman of Heritage Action, the political arm of The Heritage Foundation. "It is a bailout for the left's Green New Deal and an insult to the American taxpayers."

Speaking for the Independent Women’s Forum, Carrie Sheffield tells AFN the legislation is a “tax-and-spend giveaway” that will hurt American families that are already struggling in the inflation-battered economy. The plan to increase taxes on corporations will simply be passed down to “everyday people” who will suffer.

Speaking for the Independent Women’s Forum, Carrie Sheffield tells AFN the legislation is a “tax-and-spend giveaway” that will hurt American families that are already struggling in the inflation-battered economy. The plan to increase taxes on corporations will simply be passed down to “everyday people” who will suffer.

“It is going to cause less money to be in people's pockets at the end of the day,” she complains. “And by increasing the taxes on the corporations, that's going to cause the costs to increase which is actually going to increase inflation."

Editor's Note: Photo at top is from the Office Of Senate Majority Leader Chuck Schumer