The idea the federal government will one day own your bank account, and can monitor and control your deposits and withdrawals, might sound like a conspiracy theory except for one key fact: It’s coming soon, with little fanfare, to a bank near you. Last fall, in September, the Biden administration announced plans to study what it called a “responsible development of digital assets.” That plan is moving forward, quickly.

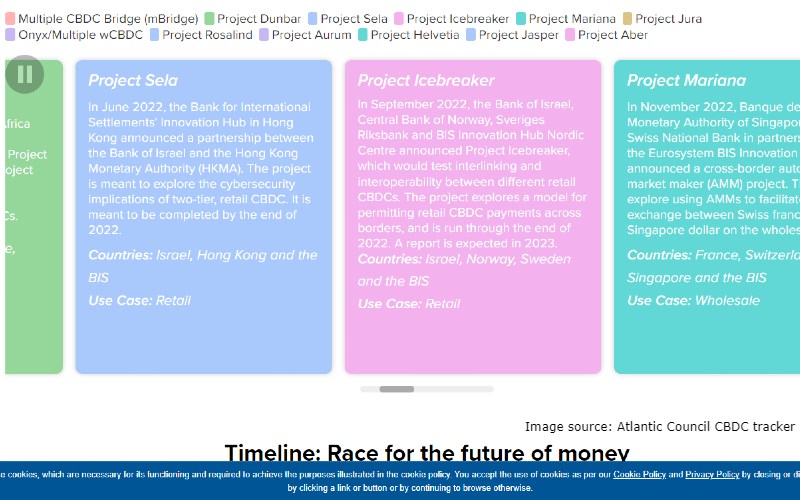

Back in January, financial news website American Banker reported 17 Central Bank Digital Currency (CBDC) projects are in the pilot phase around the world. A whopping 72 others are in the research and development phase. So, all totaled, 80% of the world’s central banks are considering a CBDC or have already launched one, the story reported five months ago.

Back in January, financial news website American Banker reported 17 Central Bank Digital Currency (CBDC) projects are in the pilot phase around the world. A whopping 72 others are in the research and development phase. So, all totaled, 80% of the world’s central banks are considering a CBDC or have already launched one, the story reported five months ago.

Here in the U.S., a 12-week “pilot program” to test a Central Bank Digital Currency launched late last year. Global banking giants Citigroup, Mastercard, and Wells Fargo worked with the Federal Reserve of New York to test how banks using digital dollar tokens in a common database can “speed up payments,” Reuters, the news wire service, reported at the time.

Over at the Atlantic Council, the globalist organization has a web page dedicated to tracking the progress of a Central Bank Digital Currency around the world. The progress in the United States mirrors this AFN story, such as the New York Federal Reserve pilot program, which was named "Project Cedar."

So, in reality, the digital dollar is on its way unless Congress, led by Sen. Ted Cruz (R-Texas), is willing to stop it.

So, in reality, the digital dollar is on its way unless Congress, led by Sen. Ted Cruz (R-Texas), is willing to stop it.

Justin Haskins, director of the Socialism Research Center at The Heartland Institute, tells AFN the danger of a digitized dollar is just as ominous as it sounds. That is because the Federal Reserve would own your bank account and own your digitized funds, too.

"Even if you are entitled to use them in some fashion, you really would not own the money. The money would be owned by the bank that is housing the money,” he explains. “Unlike the current system, you couldn't just go to the bank and take the money out in cash, and walk out the door, because the money is digital."

In a related op-ed published at Fox News, Haskins points out the public must grasp the fact the government’s current plan for a digital currency eliminates cash:

A CBDC would not be a digital version of the existing paper-based dollar, but rather an entirely new currency that would exist exclusively in a digital (meaning an electronic, non-physical) form.

So that means the Biden administration has the power, for example, to control how much gasoline you put in your automobile – and hence how often and how far you drive – with a “few clicks on a computer,” Haskins warns in the column.

So that means the Biden administration has the power, for example, to control how much gasoline you put in your automobile – and hence how often and how far you drive – with a “few clicks on a computer,” Haskins warns in the column.

Farther down in his warning about a CBDC, Haskins acknowledges that banks technically gain ownership of your money when it is deposited. But that money becomes yours again, he says, when you ask to withdraw it. If your paycheck hits a Federal Reserve-controlled account, he warns, there is nothing to withdraw and to hold in your hand. Even worse, he warns, it was never yours to own at all.

Asked to comment about the Central Bank Digital Currency, financial expert Rob West tells AFN the “tremendous loss of privacy” concerns him most.

“They know who has it. They impose the rules. They could conceivably limit transactions,” West, host of the AFR show “Faith and Finance,” warns.

Even if the federal government can control itself and not use such immense power to control you, West adds, your financial information is now accessible to millions of bureaucratic eyes and can easily be leaked if the goal is to punish, hurt, or bully you.

Haskins insists that every American – from every political viewpoint – should be terrified of a CBDC and so everyone should urge Congress to stop it.

“There are aspects to this that are really terrifying that I think the average Socialist walking down the street would not want," says Haskins. "I mean, do you think the average Socialist would want a President Donald Trump to have the ability to know every single purchase that they are making? I do not think so."