The U.S. is looking into the possibility of switching over to digital currency, meaning government-backed virtual dollars would take the place of cash – enabling purchases, payments, or transfers to happen almost immediately.

Rob West of "MoneyWise" recently told the "Today's Issues" crew that the foundation is already being laid. The Biden administration asked for a report, and when it came out, the central bank decided "this is the direction we should go."

He said it would benefit the American dollar in some ways.

"They'll tell you it's for efficient transactions and security, and yes, it would probably help to continue to prop up the U.S. dollar as the world's reserve currency, because it would make accessing U.S. dollars internationally by the governments easier," West explained.

The drawbacks, however, outweigh the benefits. For example, if the government is stoking inflation by printing too much money now, how might things be if they were able to create currency with a few keystrokes?

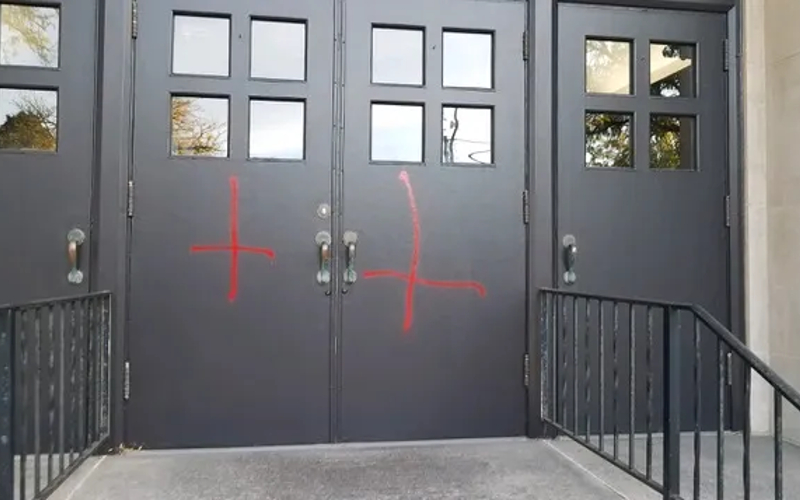

Also, while foreign governments would have easy access to U.S. dollars, so would the U.S. government, which would not likely be a favorable system for anyone who steps out of line. West pointed out that in China, the government can and does block and take money away from citizens who are doing subversive things – like going to church.

So he said it is fortunate that political roadblocks are in the way.

"The power for coinage comes from Congress, so it would take both houses and the president to get anything to move forward," West noted.

And the bottom line, he said, is the central bank does not have "any authority to do anything."