Critics have called the President’s tariffs a tax on U.S. consumers that could total almost $1,300 in 2025.

They have impacted the U.S. GDP as well as U.S. exports, leading to retaliatory measures from trading partners.

The U.S. effective tariff rate, which measures the impact of tariffs is 28%, its highest since 1901.

Yet Trump, now 100 days into his second term, keeps insisting that rebalancing unfair trade agreements through tariffs will lead to economic growth in the U.S.

Yet Trump, now 100 days into his second term, keeps insisting that rebalancing unfair trade agreements through tariffs will lead to economic growth in the U.S.

Tariffs, he says, will address the injustices of global trade, strengthen U.S. manufacturing, and align with the administration’s “Made in America” priority.

If the country gives tariffs time to work, “it will be making a fortune,” Trump told Time Magazine.

In the short term there’s pain … but not only pain for the U.S. it seems.

Gordon Chang, a noted authority and author on China, has spoken on the interview circuit about the economic struggles of the Communist-run nation.

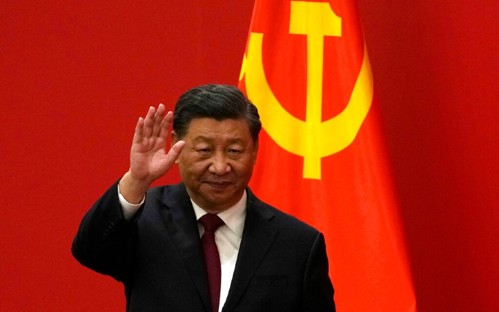

“I think Xi Jinping is in a very difficult position right now,” Chang said earlier this month.

China depends on the U.S. far more than the other way around.

“Their economy needs America to buy their products, especially now, because Xi Jinping has turned his back on consumption as the fundamental basis of the Chinese economy, which means his only way out of an increasingly serious situation is to export more. He can't replace the U.S. market, the largest in the world," Chang said.

China feeling impact of tariffs

Now the signs of wear and tear are beginning to show in China in spite of the government’s bloated assessments.

There is tough talk from Chinese President Xi Jinping and other leaders, but there are also reports that China is considering elimination of some of its tariffs on U.S. goods, ranging from vaccines and chemicals to jet engines, a list of more than 130 categories of eligible products, according to FoxBusiness.com.

Late last year, the Chinese government announced 5% growth, a fair number for the world’s second-largest economy.

It looks good on the surface, but the reality is far different, writes Vidhu Shekhar, an assistant professor of finance and economics at Bhavan’s SPJIMR, Mumbai, for Indian online magazine Swarajya.

It looks good on the surface, but the reality is far different, writes Vidhu Shekhar, an assistant professor of finance and economics at Bhavan’s SPJIMR, Mumbai, for Indian online magazine Swarajya.

But the actual economic activity that people feel — in terms of wages, prices, and business earnings — tells a different story.

What is further interesting to note is that in 2024, China’s nominal GDP grew just 4.2%, as against the real GDP growth of 5%. Typically, nominal GDP grows faster than real GDP because it includes inflation.

Here, a lower nominal GDP suggests that prices are falling across the board, signaling what is known as deflation — something that economists fear much more than inflation, for it represents an utterly stagnating economy, Shekhar writes.

Rhodium Group, an independent research firm, estimates China’s real growth number to be between 2.4% and 2.8% -- and that’s boosted by significant government support, Swarajya reports.

What does all that mean? Foreign investors are pulling out, unemployment among the young is on the rise, big real estate companies are collapsing, and prices in factories and shops are steadily falling, Swarajya reports.

“We’re starting to see factories close, especially in the export sector in the South. The layoffs are going to start rolling. They're going to even be worse than they have been,” Chang said on Washington Watch Tuesday.

China’s economy was contracting before Trump placed tariffs of 145% on its goods, Chang told show host Jody Hice.

“It’s hard to reconcile an economy in a deflationary spiral with robust growth. So now when China can't export because of these tariffs, because their exports are way down, I think we're going to see a Chinese economy that will be plunging,” Chang said.

“It’s hard to reconcile an economy in a deflationary spiral with robust growth. So now when China can't export because of these tariffs, because their exports are way down, I think we're going to see a Chinese economy that will be plunging,” Chang said.

While the Chinese government touts 5% growth it’s making moves that show doubt and insecurity for its future.

Chang, an outspoken critic of the Chinese Communist Party, says the government is exhibiting “end of regime conduct” in provocative military activity near South Korea, Japan, Taiwan, the Philippines and Australia.

“This is at a time when China actually needs friends because it needs to export more,” Chang said. “Yet, it is making enemies of other countries, especially countries in the region, very close to China's shores. That is lashing out.”

China getting ready for war?

Gary Bauer, a former Reagan administration staffer and now the president of American Values, believes China is preparing for war – not just economic war – against the United States.

“I would say it on a stack of Bibles, Communist China is planning to win a major war with us,” Bauer, who has long warned against the U.S. trade imbalance with China, said on American Family Radio Wednesday.

As China seeks deeper trade relationships with other nations in the face of U.S tariffs, agreements will likely have the dual effect of making those nations dependent on China then possibly allies of China in any future military actions.

“Look at what's happened already after this battle began between the president and Communist China over these tariffs. China has threatened to cut off the rare earth minerals we need to keep our military running,” Bauer told show host Fred Jackson.

Recently the U.S. has discovered that China has invested significantly in land and port facilities at both ends of the Panama Canal, a critical connection between the Atlantic and Pacific oceans, Bauer said.

Recently the U.S. has discovered that China has invested significantly in land and port facilities at both ends of the Panama Canal, a critical connection between the Atlantic and Pacific oceans, Bauer said.

Defense Secretary Pete Hegseth has expressed concerns about China’s influence with the Canal.

“Our Secretary of Defense went down there to visit and talk to the Panamanian government, and he was shocked to see signs in various places in the Panama Canal zone written in Chinese,” Bauer said.

“While America has been sleeping under sleepy President Biden, our enemies, mostly Communist China, are encircling the United States. We need to wake up and understand the dangerous position that we're in,” Bauer said.

Treasury Secretary Scott Bessent says tariffs could cause the loss of 10 million jobs in China. He made the comments to reporters in the White House briefing room Tuesday.

Treasury Secretary Scott Bessent says tariffs could cause the loss of 10 million jobs in China. He made the comments to reporters in the White House briefing room Tuesday.

Bessent would not clarify whether the U.S. and China are involved in trade talks. The U.S. has said yes; China has said no.

Bessent said there are substantial talks under way with South Korea, India and Japan.

Meanwhile, there are social media reports of riots in the streets in China.

Massive job loss forecasts

Chang says Bessent's estimates are low and that job loss in China could reach 16 million.

“It could very well be more than that because we're dealing with an export sector that is basically no customers. It was ailing last year. And now with the tariff war, it is in a position where China can't do very much except try to give subsidies or benefits, social benefits to laid off workers.”

Whether China’s apparent ease of tariffs on some U.S. goods is a signal that a trade agreement can be reached remains to be seen, Chang said.

“They don't want to talk to the United States for various political internal reasons, but they will give concessions, and that is actually folding. A lot of people say, ‘oh, President Trump folded. I don't think he did, but clearly China is.”