Dave Arnott, an economics professor at Dallas Baptist University, says the Inflation Reduction Act of President Joe Biden has no chance to ease the financial burden of Americans. The stated goals of the IRA, signed into law last year, were to curb inflation by reducing the deficit, lowering prescription drug prices, and investing in clean energy initiatives.

“The Inflation reduction Act was just a canard. I mean, it was almost laughable," Arnott recently told American Family Radio. "It makes us think of George Orwell's 1984, where they talked about ‘Newspeak,’ where words mean the opposite of what they say."

Why that comparison? Because the Inflation Reduction Act caused inflation, Arnott said, despite the name.

"It's very simple economics. The more dollars you add to the supply, the less each one is worth," he explained. "And people understand this. This inflation was not natural. It was caused by fiscal policy."

"It's very simple economics. The more dollars you add to the supply, the less each one is worth," he explained. "And people understand this. This inflation was not natural. It was caused by fiscal policy."

In a repeat of tough times during the Carter administration, inflation reached a 40-year high last summer as it peaked at 9.1%. Food prices in 2022 jumped 8.8% compared to 2021, a fact nobody who bought groceries was disputing at the time.

Inflation has leveled off a bit coming in at 4.0% but painful reminders abound. The average price of gas when Biden took office was $2.39 a gallon compared to $3.58 today.

Even though virtually every American family was reeling from record-high gas prices, the climate change-fearing Biden administration cheered that pain because Democrats want people driving electric automobiles.

When that pain showed up in the polls, however, President Biden blamed Russia's president Vladimir Putin for record-breaking inflation and spiking gas prices in the U.S. Biden called it the "Putin tax."

President Biden's economic-related claims over the last two years have forced liberal media outlets, such as CNN and The Associated Press, to fact-check him.

President Biden's economic-related claims over the last two years have forced liberal media outlets, such as CNN and The Associated Press, to fact-check him.

So it really can seem Orwell-esque at times to witness an American president blame others for his failures and claim victory from other people's successes.

Meanwhile, Arnott says inflation was so low under former president Donald Trump that the economy could have benefited from a mild dose of inflation.

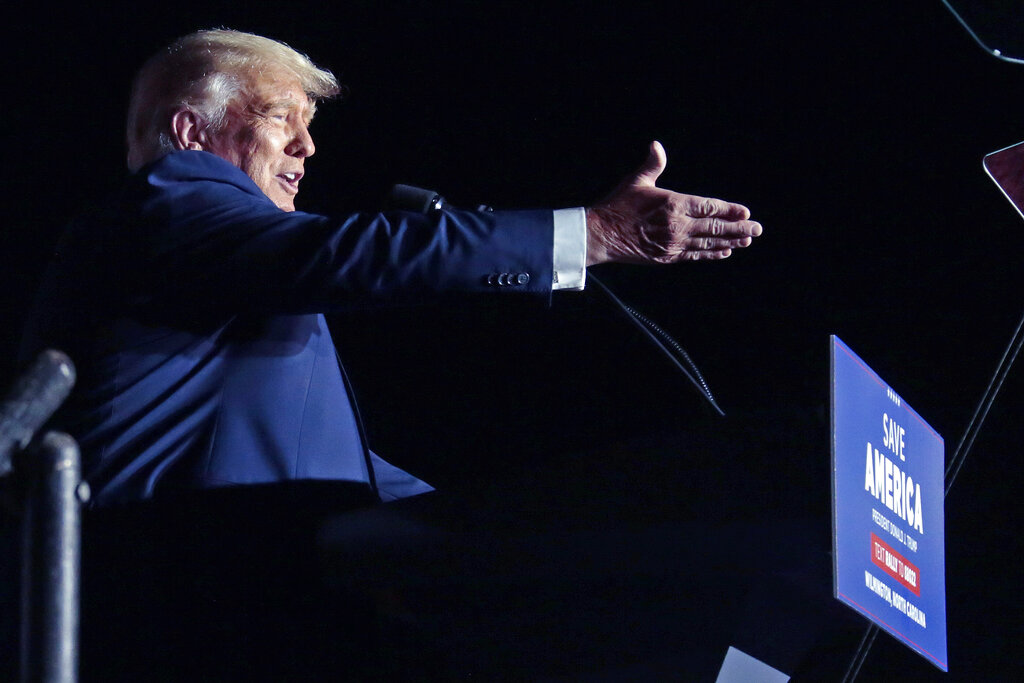

“Just a few years ago, inflation was stuck around 1.2% to 1.4%, and really all the economists were saying, How do we increase inflation?' That's astounding to think about," Arnott told show host Jenna Ellis. "That's because during the Trump administration, the policies encouraged productivity. You can have increasing wages and prices if people are producing more. It was the fiscal policies of the Trump administration, which encouraged people to produce more."

There’s a temptation, Arnott says, to believe inflation impacts the wealthy because of their bank accounts more than it would the poor, but that’s not the case.

“The rich can move their assets. Into things like gold and real estate and stocks, which will weather out the storm and go up (in value) with inflation," he explained. "If you're poor, you don't have money to invest. If you're poor, you have to buy milk and diapers on the weekly market.”

Inflation at home has created difficulties for trade partners overseas.

Federal Reserve officials at last fall’s meeting of the International Monetary Fund and World Bank, hosted in Washington, heard complaints that the cost of imports from the U.S. was creating inflation in their own countries.

Inflation’s double whammy on the poor

According to Arnott, data that shows increased wages under Biden should be carefully considered. The numbers negatively impact the poor.

“Now, data shows that since Biden took office, wages are up 14%, but inflation is up 15%, so they're losing by one. Well, you might look at it and say, ‘Okay, it's only one,’ but a tax bill will come soon," he said. "It's something called bracket creep. So if you're making 15% more, that means you're going to pay higher taxes at the end of the year."

COVID-19 and the resulting economic fallout touched both the end of the Trump administration and the beginning of the Biden administration.

COVID-19 and the resulting economic fallout touched both the end of the Trump administration and the beginning of the Biden administration.

“The Federal Reserve was formed in 1913 for one purpose: stable prices," Arnott concluded. "They have failed, and the reason they have failed in monetary policy is because they're having to keep up with the fiscal policy of spending."